Picture this: A Seoul-based K-beauty startup launches a viral vitamin C serum, but instead of investing millions in factories, they partner with a Philippine manufacturer. Six months later, their product is on shelves worldwide—sans the overhead. This isn’t luck; it’s the power of cosmetics toll manufacturing, a strategy fueling brands from indie labels to household names. And the Philippines? It’s quietly dominating as the region’s smartest outsourcing hub. Here’s why.

Toll Manufacturing 101: Your Formula, Their Expertise

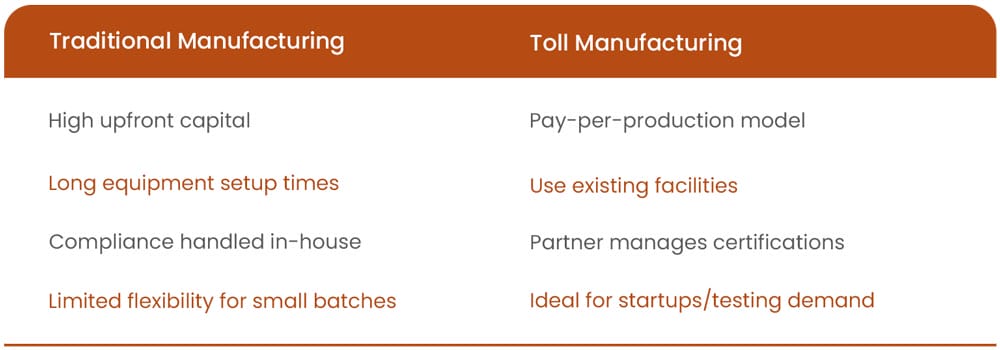

Toll manufacturing lets brands sidestep the headaches of factory ownership. You provide the recipe, packaging, and vision; your partner handles production, compliance, and scaling. It’s like a ghost kitchen for cosmetics—low risk, high agility. The Philippines has emerged as a hotspot for this model, with its cosmetic exports growing 17% year-over-year, per the Philippine Statistics Authority.

The Philippine Edge: More Than Just Cost Savings

Sure, labor costs here are 30% lower than in China, according to World Bank data. But the real magic lies in the details:

- Regulatory savvy: The Philippines follows ASEAN Cosmetic Directive standards, aligning with EU regulations—a golden ticket for global distribution.

- Ingredient innovation: Local manufacturers excel at tropical-friendly formulations (think: humidity-resistant creams, UV-blocking serums).

- Speed-to-market: Proximity to major Asian ports slashes shipping times to markets like Japan and Australia.

3 Trends Driving the Philippines’ Cosmetic Boom

- Clean Beauty Demand: Brands like Human Nature (a Philippine success story) prove local manufacturers can pivot to organic, vegan formulas fast.

- Hybrid Textures: Think jelly cleansers, serum-infused masks—products requiring niche tech that toll partners already master.

- Custom Packaging: From bamboo compacts to refillable airless pumps, Philippine factories blend eco-innovation with cost efficiency.

Choosing Your Partner: 5 Non-Negotiables

Not all toll manufacturers are equal. Prioritize partners who:

- Specialize in cosmetics (not just “general goods”).

- Offer end-to-end services (R&D, filling, labeling, export docs).

- Have FDA/ISO certifications—non-negotiable for U.S./EU markets.

- Provide small MOQs (500–1,000 units) for startups.

- Embrace sustainability (zero-waste processes, solar-powered facilities).

This is where Vitamen Beverage Concept, Inc shines. With a focus on customizable, eco-conscious production, they’ve become the backstage force for brands wanting premium quality without the factory footprint.

The Hidden Costs of Cheap Partners

A 2023 ASEAN Cosmetics Association report found that 41% of brands using budget manufacturers faced issues:

- Delays from outdated equipment

- Mislabeled ingredients causing customs holds

- Poor QC leading to product recalls

Ready to Launch Your Line?

The Philippine toll manufacturing scene is buzzing—but success hinges on choosing a partner who treats your brand like their own.

Phone Number: 09171253990 or 09171093067

Email: askvbc@vbcmade.com

Address: 193 Marcos Highway, Sitio Inuman, Antipolo City and 11 Eulogio Rodriquez Jr. Ave, Pasig City, Metro Manila

Direction: https://maps.app.goo.gl/aHEXgDR8Tm3VrfVPA